$4,983 IRS Direct Deposit: If you’ve been scrolling through TikTok, Facebook, or Reddit and stumbled across a post claiming a $4,983 IRS direct deposit is hitting your bank account in December 2025, you’re probably thinking, “Hold up—what’s this all about?” The number’s big. The excitement is bigger. But is it true? We dug deep into government sources, tax codes, and retirement policies to separate fact from fiction. In this guide, we’ll give you the straightforward truth, with real examples, official links, and step-by-step instructions so you’ll know exactly what’s going on — and how to check if you’re eligible for any real payment.

Table of Contents

$4,983 IRS Direct Deposit

So here’s the bottom line: No, the IRS is not sending $4,983 to everyone in December 2025. That number comes from a very specific Social Security benefit, not a universal payment. But if you’re expecting a refund, Social Security check, or state rebate, those are real — and they could land in your account in December if you’re eligible. And never trust unverified social media posts or texts promising surprise cash.

| Topic | Key Facts / Stats |

|---|---|

| $4,983 IRS Direct Deposit | No official announcement or IRS-backed program for December 2025 |

| $4,983 Origin | Max monthly Social Security benefit for select retirees at age 70 |

| Refunds & Credits | Taxpayers may receive refunds for Earned Income Tax Credit (EITC), Child Tax Credit (CTC), or late filings |

| December Payments | Social Security, SSI, SSDI, VA, tax refunds, and some state rebates may be issued |

Is the $4,983 IRS Direct Deposit in December Real?

Let’s cut straight to it: No, the IRS is not sending out a $4,983 stimulus or relief payment to all Americans in December 2025.

The claim that’s been floating around online — that every American will receive this amount through a federal direct deposit — is not backed by any official legislation or government announcement.

There’s no stimulus bill passed by Congress.

No emergency relief fund allocated.

No IRS update confirming these payments.

So where’s this number coming from?

Where Does the $4,983 Number Actually Come From?

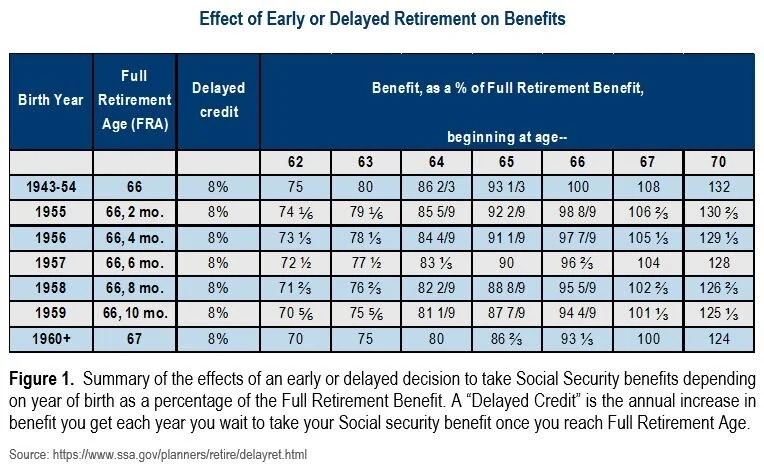

The truth is, the number does exist — but in a completely different context. According to the Social Security Administration, $4,983 is the maximum monthly retirement benefit a person can receive in 2025 — but only under very specific conditions.

You’d have to:

- Have earned maximum taxable wages ($168,600 in 2024, higher in 2025)

- Paid into Social Security for at least 35 years

- Delay your retirement until age 70

Most retirees don’t come close to this amount. As of 2024, the average Social Security retirement benefit was around $1,900/month.

So yes, $4,983 is real — but it’s not a stimulus check, not a tax refund, and definitely not a surprise bonus from the IRS. It’s a high-end retirement benefit, for a very specific population.

What You Might Actually Receive in December 2025?

Just because the viral $4,983 payment isn’t real doesn’t mean all December payouts are bogus. Many Americans will receive government payments this month — but based on actual eligibility, programs, or filing status.

Here’s what you may be eligible for:

1. Social Security Retirement and Disability Payments

If you’re receiving:

- Social Security Retirement

- SSDI (Disability Insurance)

- Survivors’ or Spousal Benefits

Then you’ll get your regularly scheduled payment based on your birth date. These benefits are deposited monthly.

Some people may even receive two payments in December if January 2026’s check falls on a holiday or weekend.

2. Supplemental Security Income (SSI)

SSI is different from traditional Social Security. It’s designed for low-income seniors and disabled individuals. In 2025, the maximum federal SSI benefit is estimated around $943 for individuals and $1,415 for couples, although some states offer additional supplements.

Some SSI recipients may receive two checks in December, depending on calendar quirks. The second check is not a bonus — it’s an early payment for January.

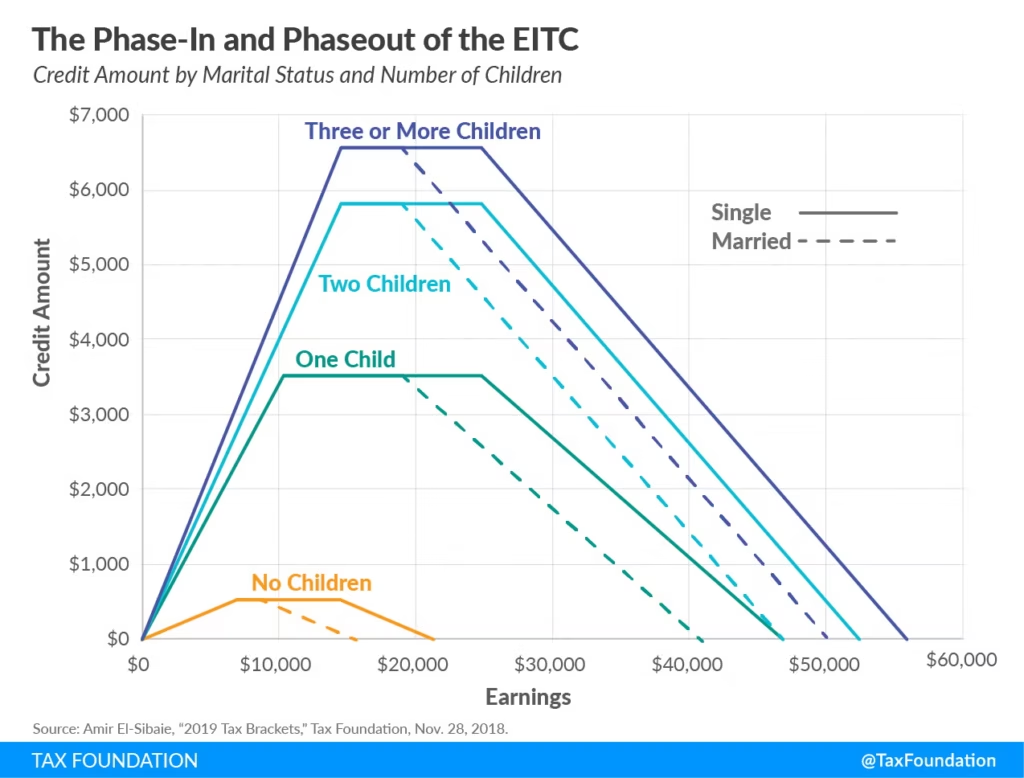

3. IRS Tax Refunds or Credit Adjustments

If you filed your 2024 taxes late, amended your return, or were waiting on IRS adjustments for credits like:

- Earned Income Tax Credit (EITC)

- Child Tax Credit (CTC)

- Recovery Rebate Credit (RRC)

…then you might receive your refund in December. But again, it’s based on your unique tax situation.

There is no flat $4,983 amount tied to these credits. Most EITC refunds range from $500 to $3,995, depending on income and number of dependents.

4. Veterans Benefits and Federal Pensions

If you’re a veteran, survivor, or retiree receiving federal pensions, your payments are deposited monthly, too — often in early December.

VA benefits are adjusted annually for inflation. In 2025, the cost-of-living adjustment (COLA) could slightly boost your benefit amount — but again, not to $4,983 unless that’s your typical benefit.

5. State-Specific Rebates

Some states, like:

- California (Middle Class Tax Refund)

- Colorado (TABOR refund)

- New Mexico (Relief Rebates)

…offer one-time tax rebates or inflation relief checks based on income or residency. These programs change year to year.

How to Check if You’re Getting $4,983 IRS Direct Deposit?

If you’re unsure whether a payment is coming your way, use these official tools to verify:

Step 1: Use the IRS “Where’s My Refund” Tool

You’ll need:

- Social Security Number or ITIN

- Filing status

- Exact refund amount expected

This tool is updated once daily, typically overnight.

Step 2: Log In to “My Social Security” Online

You can:

- View past deposits

- Check upcoming payment dates

- Estimate your future retirement benefits

This account also lets you set up direct deposit updates or order benefit letters.

Step 3: Check State Tax Portals

Visit your state Department of Revenue website to see:

- Refund status

- Stimulus eligibility

- Property tax credits or energy rebates

Watch Out: Scammers Are Exploiting This Rumor

Where there’s confusion, there are scammers. And unfortunately, the $4,983 rumor has led to a spike in phishing texts, emails, and fake websites.

Common red flags include:

- Promises of “instant cash” or “IRS stimulus access”

- Requests for your Social Security number or bank login

- Fake IRS-looking emails or texts saying “Your payment is pending. Click here.”

The IRS will never call, text, or email you to verify your account or payment method.

Real Examples to Make It Clear

Let’s simplify with a few case studies:

Example 1: Maria, Age 70, Retired CEO

Maria delayed her retirement until 70 and earned maximum taxable income throughout her career. She now receives the full $4,983/month in Social Security.

Real

Not a bonus or stimulus

Based on her earnings and delay strategy

Example 2: James, 33, Warehouse Worker, 2 Kids

James filed his 2024 taxes with two dependents and qualified for EITC and CTC. He expects a refund of $4,100, which may arrive in December due to late filing.

Real IRS refund

Not $4,983 flat

Based on his actual credits

Example 3: Sarah, 58, Sees Viral Post

Sarah clicks on a social post that claims she can get a $4,983 check if she enters her bank info. The link takes her to a sketchy third-party site.

Scam

No IRS connection

Personal info at risk

$2,000 Direct Payments Approved by IRS — Millions to Receive Funds Starting December 18

IRS Announces $1,390 Direct Deposit Relief Payment For December 2025

IRS Confirms $2,000 Direct Deposit for December 2025: Eligibility, Payment Dates & How to Get Yours