After weeks of warnings that Social Security paper checks would end permanently, U.S. federal agencies are now allowing mailed payments to continue for beneficiaries unable to switch to electronic methods, softening what had been presented as a firm policy deadline and raising questions about how the transition was communicated.

Table of Contents

Social Security Paper Checks

| Key Fact | Detail |

|---|---|

| Planned cutoff | Sept. 30, 2025 |

| Current status | Paper checks still allowed for hardship cases |

| Share of recipients | Fewer than 1% receive paper checks |

| Alternatives | Direct deposit, Direct Express® card |

| Core concern | Access barriers for seniors and unbanked |

The government’s retreat from a hard deadline underscores the tension between efficiency and equity in public policy. While electronic payments may represent the future, the experience has shown that transitions affecting essential income require flexibility, clarity, and patience.

A Policy Framed as Final, Then Quietly Revised

For much of 2025, the message from the U.S. Department of the Treasury and the Social Security Administration (SSA) appeared unequivocal: paper Social Security checks were on their way out.

Mailers, online notices, and public guidance repeatedly emphasized a “final” transition deadline of September 30, urging beneficiaries to enroll in direct deposit or the government’s prepaid Direct Express® debit card. The move aligned with a broader federal initiative to modernize payment systems and reduce fraud.

Yet in the weeks following that deadline, federal agencies have softened their language.

Updated guidance now confirms that benefits will not be suspended for recipients who cannot reasonably adopt electronic payment methods. Instead, paper checks will continue for those who qualify for hardship exceptions, marking a notable retreat from earlier rhetoric.

Why the Government Wanted to End Paper Checks

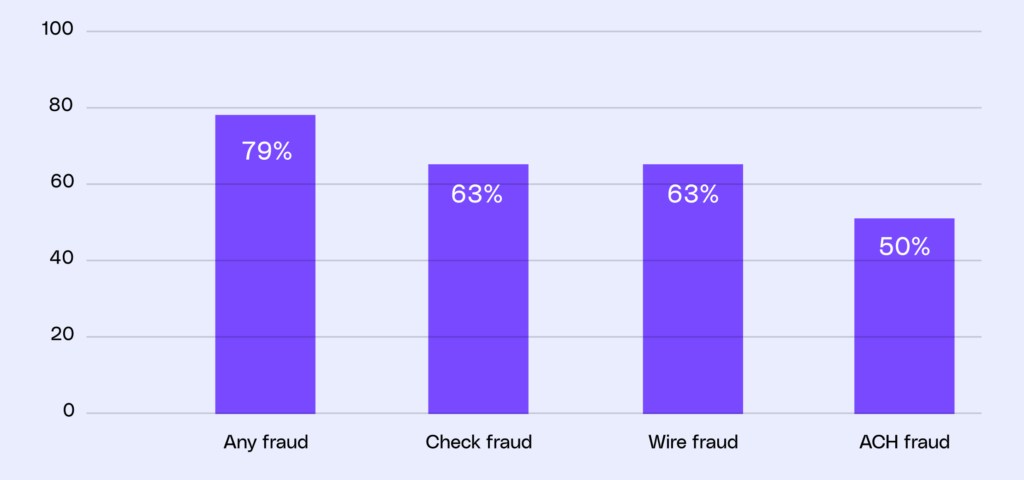

The push to eliminate paper checks did not originate with Social Security alone. It stemmed from a Treasury-led modernization effort covering all federal payments, including tax refunds and veterans’ benefits.

According to Treasury data, electronic payments:

- Cost significantly less to issue than mailed checks

- Are less vulnerable to theft or fraud

- Reach recipients faster and more reliably

A Treasury official previously described paper checks as “one of the most expensive and fraud-prone payment methods still in use.”

Who Still Relies on Social Security Paper Checks

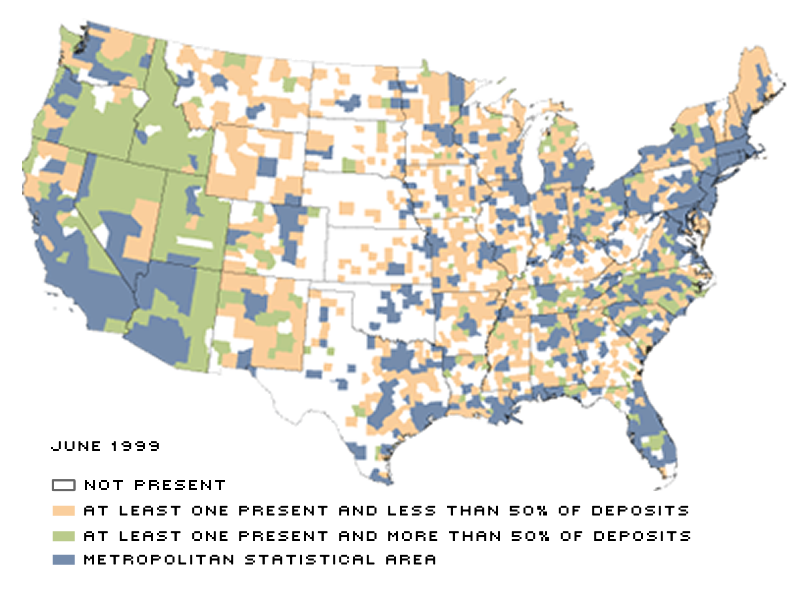

Despite years of encouragement to switch, tens of thousands of beneficiaries still receive paper Social Security checks, often by necessity rather than preference.

According to the SSA, those recipients are disproportionately:

- Older Americans, including individuals in their late 80s and 90s

- Rural residents with limited banking infrastructure

- Unbanked or underbanked individuals, particularly among low-income households

- People with disabilities or cognitive impairments who rely on familiar systems

Advocacy groups warned that a hard cutoff could leave some beneficiaries without timely access to their sole source of income.

“For many seniors, especially those living alone, the paper check isn’t just a payment mechanism — it’s a lifeline they understand and trust,” said one aging-policy analyst.

The Digital Divide Behind the Policy Reversal

Experts say the government’s quiet recalibration reflects a deeper reality: digital access remains uneven, particularly among older Americans.

Federal Reserve research shows millions of U.S. adults still lack a traditional bank account. Pew Research Center surveys consistently find that older adults are far less likely to use online banking or mobile payment tools.

This gap becomes more consequential when benefits are at stake.

“Modernization works best when it’s additive, not punitive,” said a public policy professor specializing in aging and technology. “When the fallback option disappears, the people most likely to be harmed are those with the fewest alternatives.”

How the Exception System Works

Under current guidance, beneficiaries who cannot switch to electronic payments may request a waiver or hardship exception.

While the SSA has not published exhaustive criteria, exceptions generally apply when individuals:

- Lack access to a bank or credit union

- Cannot safely manage electronic payments

- Face technological or cognitive barriers

Importantly, officials now say benefits will continue uninterrupted while cases are reviewed, reducing fears of sudden payment loss.

The SSA continues to encourage electronic enrollment but acknowledges that “not all recipients can transition at the same pace.”

Communication Breakdown and Public Confusion

The shift has drawn criticism not for the outcome, but for how the policy was communicated.

Multiple notices described the September deadline as final, leaving some recipients anxious that their checks would stop. Only later did agencies clarify that the transition would be flexible.

“This could have been handled with clearer language from the start,” said a former SSA official. “Deadlines matter, especially when people rely on these payments for rent and food.”

How Other Countries Handle Benefit Payments

The United States is not alone in pushing digital benefit delivery.

Countries such as the United Kingdom, Canada, and Australia have largely transitioned to electronic payments but retain limited accommodations for citizens facing access barriers.

Policy analysts note that successful transitions abroad relied heavily on long transition periods, personalized assistance, and explicit assurances that no one would lose benefits due to technical hurdles.

What Beneficiaries Are Being Asked to Do Now

Federal agencies continue to urge recipients to adopt electronic options when feasible.

Available methods include:

- Direct deposit to a bank or credit union account

- Direct Express® prepaid debit card, designed for unbanked recipients

- In-person or phone assistance through SSA offices

Officials stress that electronic payments remain the preferred method, but not a mandatory one for all.

What Comes Next

The Treasury Department has indicated it will continue monitoring the transition and may refine guidance further as outreach continues.

For now, the policy stands as a phased transition, not an abrupt termination.

“The goal remains modernization,” one official said, “but not at the expense of access.”

FAQ

Are Social Security paper checks completely ending?

No. Paper checks will continue for beneficiaries who qualify for hardship or access-related exceptions.

Will my benefits stop if I don’t switch right away?

No. SSA officials say benefits will not be suspended solely for failure to enroll electronically.

What is the safest payment method?

Treasury officials recommend direct deposit or the Direct Express® card for speed and security.

How do I request an exception?

Beneficiaries should contact the SSA directly by phone or visit a local office.