A U.S. local government has launched the country’s first publicly funded $500 monthly guaranteed income program, providing $500 in unconditional monthly cash payments to eligible residents as part of a long-term strategy to reduce financial instability. The initiative represents a significant shift in American social policy, emphasizing direct income support rather than traditional conditional assistance programs.

Table of Contents

$500 monthly guaranteed income program

| Key Area | Details |

|---|---|

| Monthly payment | $500 per eligible participant |

| Conditions | No work or spending requirements |

| Selection | Income eligibility followed by lottery |

| Funding | Local government budget allocation |

| Duration | Multi-year with ongoing evaluation |

| Purpose | Financial stability and poverty reduction |

What the $500 Monthly Guaranteed Income Program Is

The $500 monthly guaranteed income program is a publicly funded initiative that delivers recurring cash payments directly to individuals or households that meet defined eligibility requirements. Unlike most existing assistance programs, the payments are unconditional. Recipients are not required to work, seek employment, enroll in training, or document how the money is spent.

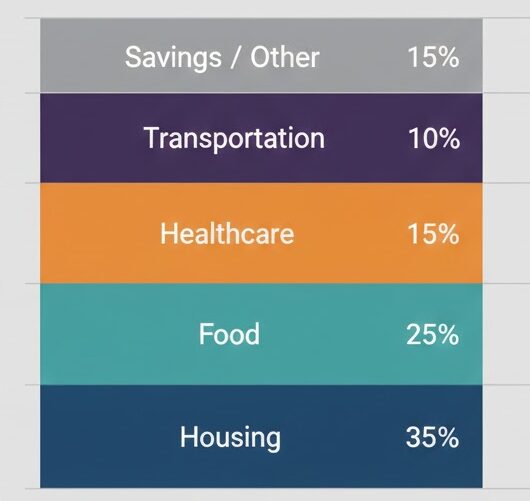

Program administrators describe the initiative as a modern response to economic conditions that have left many households financially exposed despite employment. Rising housing costs, healthcare expenses, childcare fees, and transportation costs have increasingly outpaced wage growth for low- and middle-income earners.

The program’s designers emphasize that the payments are meant to supplement household income, not replace wages or encourage workforce exit. Officials say the goal is to provide predictable financial support that allows families to better manage monthly expenses and unexpected costs.

Historical Context: How Guaranteed Income Entered U.S. Policy

Guaranteed income is not a new idea in American economic thought. Versions of direct cash support have been debated for decades, including proposals for a negative income tax during the mid-20th century. While those ideas were never adopted nationally, they influenced later welfare reforms and tax credits.

In recent years, interest in guaranteed income resurfaced amid growing income volatility, the rise of gig work, and economic shocks that exposed gaps in the social safety net. Local governments began experimenting with small pilot programs, often funded by private donations or temporary grants.

What distinguishes this program is its transition from pilot to publicly funded policy. By committing taxpayer funds and embedding the initiative into a formal budget process, local officials have moved guaranteed income from experimentation into governance.

Why the Program Was Created

Economic Pressures Facing Households

Local leaders cite data showing that a large share of residents experience financial instability even when employed. Irregular work hours, unpredictable expenses, and limited savings leave households vulnerable to emergencies such as medical bills or car repairs.

Traditional assistance programs often require extensive paperwork and strict eligibility rules, which can delay help. Guaranteed income, by contrast, delivers cash quickly and consistently, allowing households to decide how best to address their needs.

“Stability is the foundation of economic mobility,” a senior program administrator said during the program’s announcement. “When families know they will receive a fixed amount each month, they can plan instead of react.”

Who Qualifies for the $500 Monthly Payments

Residency Requirements

Applicants must reside within the jurisdiction administering the program. Proof of residency is required during the application process to ensure funds remain within the local community.

Income Thresholds

Eligibility is limited to households below a specified income ceiling. The threshold is typically tied to federal poverty benchmarks or median income levels, allowing participation by low- and moderate-income earners, including those who are fully employed.

Program officials say this approach reflects the reality that financial strain is not limited to the unemployed.

Age and Household Rules

Applicants must be adults. In most cases, households are limited to one participant to maximize the number of families served.

Lottery-Based Selection

Because demand exceeds available funding, eligible applicants are selected through a random lottery. Administrators say the lottery system promotes fairness and transparency while preventing favoritism.

How Payments Are Distributed

Participants receive $500 each month through direct deposit or prepaid debit cards. Payments are issued on a fixed schedule to provide predictability.

There are no spending restrictions. Recipients are not required to submit receipts, attend check-ins, or complete progress reports. Program administrators say this reduces administrative overhead and respects recipient autonomy.

Officials also note that unconditional payments lower operational costs compared to traditional welfare programs, which often require extensive compliance monitoring.

How the Program Is Funded

The program is financed through the local government’s general budget. Funding decisions were approved through a public legislative process, with elected officials voting to allocate resources over multiple fiscal years.

Supporters argue that the program represents a relatively small share of the overall budget while delivering outsized benefits to participating households. Critics, however, question whether guaranteed income should compete with other public priorities such as infrastructure, public safety, or education.

Budget officials say the program will be reevaluated annually, with continuation dependent on financial performance and measured outcomes.

Oversight, Accountability, and Evaluation

To address concerns about transparency, the program includes built-in oversight mechanisms. Administrators track participation rates, payment delivery, and demographic data, while independent evaluators assess outcomes.

Evaluation metrics include financial stability, housing security, food access, and employment trends. Officials stress that participation does not require behavior changes, but outcomes are studied in aggregate to inform policy decisions.

Annual reports are expected to be released to lawmakers and the public, providing updates on program costs and observed impacts.

How Guaranteed Income Differs From Traditional Welfare

Traditional welfare programs often restrict how benefits are used and require recipients to meet ongoing conditions. Guaranteed income removes those requirements, shifting decision-making power to households.

Supporters argue this approach acknowledges that recipients are best positioned to understand their own needs. Critics counter that unrestricted cash lacks safeguards to ensure funds are used productively.

Policy analysts note that guaranteed income does not replace existing programs but operates alongside them, potentially filling gaps rather than duplicating benefits.

Criticism and Policy Debate

Opposition to guaranteed income centers on concerns about cost, fairness, and long-term sustainability. Some critics argue that direct cash payments could discourage work or create dependency.

Program administrators respond that existing evidence shows little to no reduction in employment among recipients. They also emphasize that the payment amount is modest relative to living costs and designed to support, not replace, work income.

The debate reflects broader disagreements about the role of government in addressing economic inequality and the best methods for delivering assistance.

National Implications

Policy experts say the program is being closely watched by other local and state governments. If successful, it could influence future discussions about income supports, tax credits, and social safety net reform.

However, officials caution against viewing the initiative as a universal solution. Scaling guaranteed income nationally would require significant funding and coordination across multiple levels of government.

For now, the program serves as a real-world test of whether predictable, unconditional cash can improve household stability within existing budget constraints.

What Comes Next

Local officials say eligibility rules, funding levels, and participant numbers will be reviewed regularly. Any expansion would require additional legislative approval.

As the program moves forward, policymakers, economists, and residents alike will assess whether guaranteed income delivers measurable benefits and whether it can coexist with other public priorities.

“This program is not a final answer,” one official said. “It is a serious attempt to address a real problem with evidence, transparency, and accountability.”

FAQ

Is this a federal program?

No. The initiative is administered and funded at the local government level.

Do recipients have to pay the money back?

No. The payments are grants, not loans.

Does receiving the payment affect other benefits?

It may, depending on individual circumstances. Participants are advised to review how additional income interacts with other assistance program.